News

LG Bets on Rival TCL’s MiniLED Tech to Fight for Market Share

In a surprising twist, LG Electronics, long the loudest cheerleader for OLED TVs, is now hedging its bets. Faced with slipping market share and rising pressure from Samsung, Hisense, and TCL, LG is banking on MiniLED technology, and ironically, it is TCL, a key rival, manufacturing many of its new QNED TVs.

After selling off its final LCD factories to TCL, LG is now sourcing its QNED evo lineup directly from China. The irony cuts deep: the same MiniLED tech that’s fueling TCL’s rise is now at the core of LG’s comeback attempt. Even more complicated, LG’s imported QNED TVs land in a U.S. market increasingly hostile to Chinese manufacturing, thanks to mounting tariffs.

LG claims the new QNED series offers richer, more realistic colors across light and dark environments. But unlike traditional QLEDs, the company is touting its proprietary “Dynamic QNED Colour” engine, a different path from the quantum dot technology dominating elsewhere.

Powering the experience is LG’s in-house Alpha AI Processor 3 and WebOS. But beyond sharper images and curated recommendations, there’s a much larger play happening quietly in the background: data collection. LG has admitted to raking in over $1.5 billion last year by selling user data harvested through its smart TVs, including browsing habits, viewing preferences, and even voice profiles through AI Voice ID.

Tightly integrated AI features like AI Concierge, AI Picture Pro, and AI Search further deepen the company’s behavioral tracking. Combined with Microsoft’s Copilot integration and a web of cloud-based analytics, LG’s televisions are becoming potent data hubs disguised as entertainment centers.

And if you think you can easily opt out? LG’s warranty terms suggest otherwise. Turning off tracking isn’t just hard, it’s almost impossible without crippling the TV’s smart features.

Meanwhile, TCL Electronics just reported an 11.4 percent rise in Q1 2025 TV shipments and a 22.3 percent surge in sales revenue, driven by strong demand for larger and MiniLED TVs. The company is expanding its premium footprint globally, even as North American shipments saw a slight dip.

(Via)

News

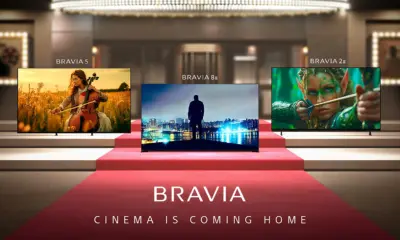

TCL Shocks Market by Taking Over Sony Bravia TVs

Sony Corporation has announced that it will spin off its home entertainment division and form a new joint venture with TCL Electronics. The partnership gives TCL a 51 percent majority stake, while Sony retains 49 percent. The new company will take control of global operations for Sony’s television and home audio business.

The companies confirmed the agreement through a signed memorandum of understanding. They plan to finalize binding terms by the end of March 2026. The joint venture is expected to begin operations in April 2027, subject to regulatory approvals.

The new entity will handle the entire value chain, including product development, manufacturing, sales, and customer service. Products from the venture will continue to use the Sony and Bravia brand names.

Sony will contribute its picture processing technology, audio expertise, and brand value. TCL will provide its display manufacturing capabilities, global supply chain, and cost-efficient operations. TCL’s recent growth in display technology and global market share positions it to take advantage of Sony’s premium image and distribution network.

Sony CEO Kimio Maki said the partnership aims to create new customer value through combined expertise. TCL Chairperson Du Juan said the deal will allow TCL to scale further into high-end markets and optimize its operations.

Sony has been gradually moving away from consumer hardware in favor of content businesses like anime, film, music, and gaming. The company previously exited the PC and tablet markets and stopped producing Blu-ray players.

This move ends Sony’s independent control of its TV business, which began in the 1960s. The joint venture gives TCL an opportunity to strengthen its position in premium global markets while maintaining the Bravia brand’s legacy. Sony will retain visibility in the home entertainment segment without managing day-to-day hardware operations.

In related news, TCL has introduced the 5G Mobile WiFi P50 and the WiFi Router BE36 at CES 2026, while also unveiling the world’s first HDR10 AR glasses, the RayNeo Air 4 Pro.

(Source)

News

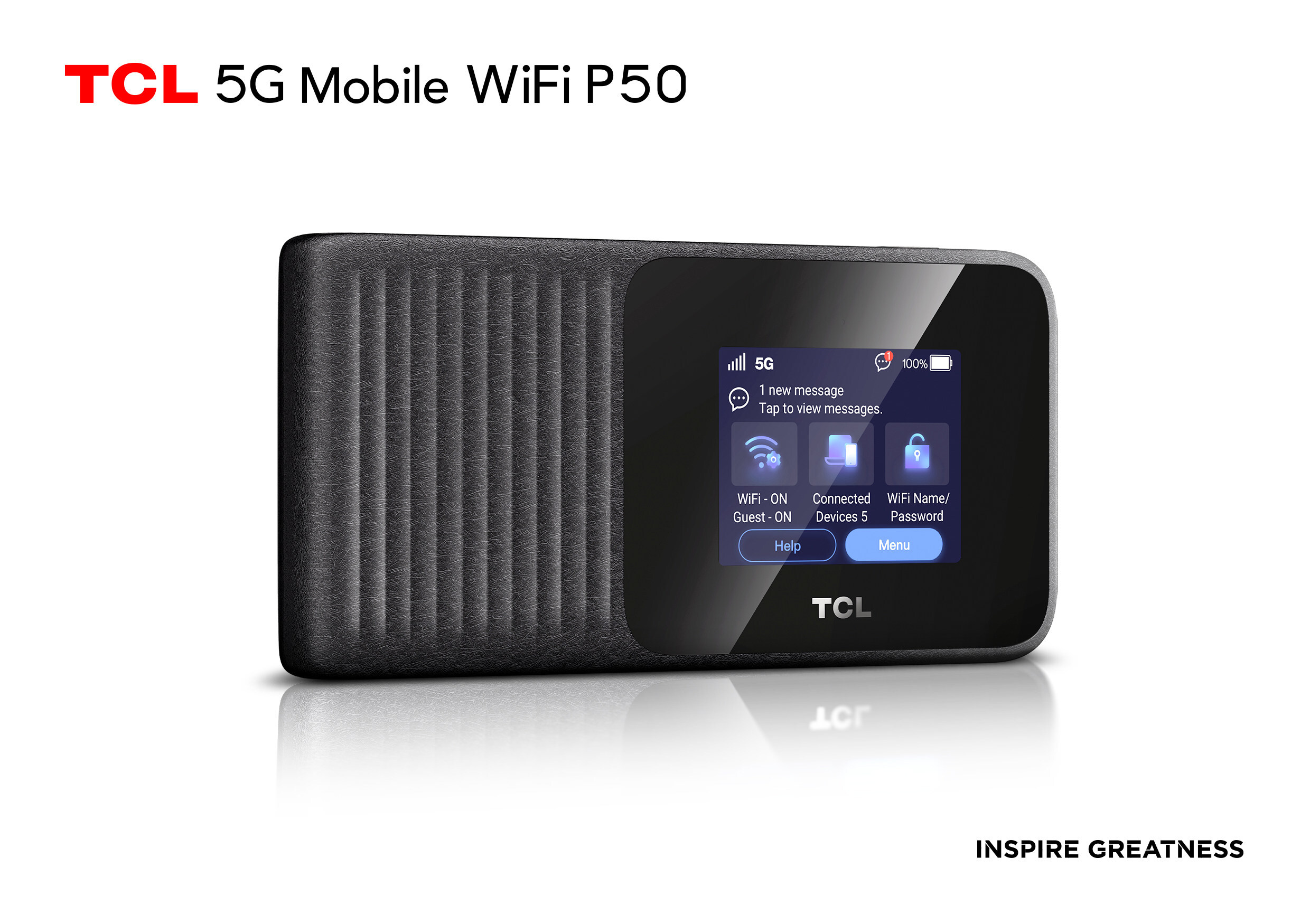

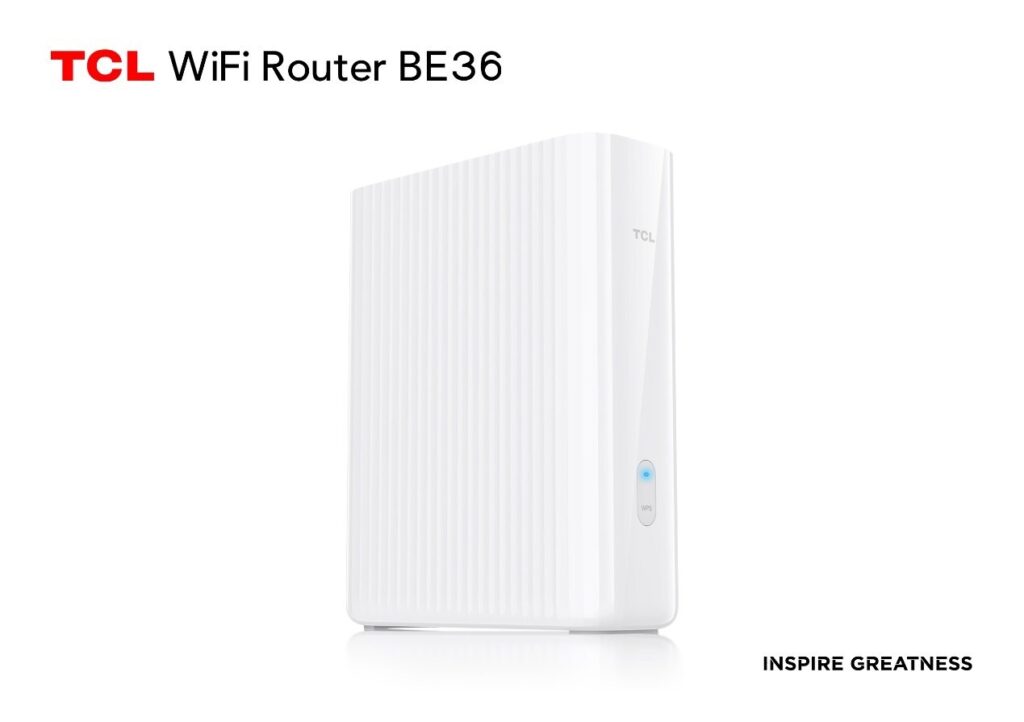

TCL Launches 5G Mobile WiFi P50 and WiFi Router BE36 at CES 2026

TCL is done waiting for the future of connectivity; it just launched it. At CES 2026, the company unveiled the 5G Mobile WiFi P50 and WiFi Router BE36, two devices designed to cover the entire spectrum of modern connectivity needs, from your backyard to your basement office.

The TCL 5G Mobile WiFi P50 is more than a pocketable hotspot. It’s the first 5G mmWave mobile router that also supports both fast charging and wireless charging. It packs a 5000mAh battery for up to 12 hours of portable use, doubles as a power bank, and features a 2.4-inch touchscreen for live network stats. On the connectivity side, it delivers up to 3.97Gbps via full-spectrum 5G (mmWave + Sub-6), and tri-band Wi-Fi 7 speeds topping 5.8Gbps for up to 64 devices. There’s even a Gigabit Ethernet port for times when wireless just won’t cut it.

While the P50 is built for mobility, the TCL WiFi Router BE36 is focused on home performance. It offers 3.6Gbps Wi-Fi 7 across dual bands, supports up to 512 device connections, and leverages 3T3R (2ss) antenna tech to boost range. It’s EasyMesh R6 compatible too, meaning you can deploy multiple units to blanket large homes in a seamless, zero dead-zone network.

Security hasn’t been left behind either. The BE36 includes firewall-level protection with malware filters, brute-force attack detection, and smart-home security baked in. There’s even a built-in VPN suite and a dedicated gaming acceleration mode. Rounding it off is a 2.5GE port for serious wired performance.

In related news, TCL also unveiled the RayNeo Air 4 Pro, billed as the world’s first HDR10-enabled AR glasses, alongside the NxtPaper 70 Pro tablet with a dedicated eye-care display and stylus support at CES 2026.

News

TCL Unveils World’s First HDR10 AR Glasses: RayNeo Air 4 Pro at CES 2026

TCL’s RayNeo has introduced the RayNeo Air 4 Pro AR glasses at CES 2026. The device is the world’s first AR glasses to support HDR10, aiming to deliver a cinema-like viewing experience in a lightweight wearable form.

RayNeo originally launched the Air 4 Pro in China last year. The company is now taking the product global, positioning it as a new category of “head-mounted TV.” The glasses feature a 201-inch virtual display at a 6-meter distance and weigh just 76 grams. They connect to USB-C display output devices, including smartphones, tablets, laptops, and gaming consoles such as the Nintendo Switch 2.

The Air 4 Pro is powered by the custom Vision 4000 chip. The processor enables real-time video enhancements, including upscaling SDR content to HDR and converting 2D video into 3D. The glasses support HDR10 for richer contrast and more vibrant color reproduction.

For audio, RayNeo collaborated with Bang & Olufsen to design a four-speaker system. The glasses use directional sound tubes to provide immersive audio while minimizing sound leakage. The sound system has been fine-tuned by B&O’s audio engineering team.

The design focuses on comfort and portability. Adjustable nose pads and a balanced frame allow for extended use. The lightweight build makes it suitable for travel and on-the-go entertainment.

RayNeo plans to launch the Air 4 Pro globally on January 25 for $299. The price undercuts many other AR glasses in the market, making it one of the most affordable options in its class.

If you are planning to buy an AR headset right now, the Air 3s Pro is also worth considering, as it is currently on sale for $249.