News

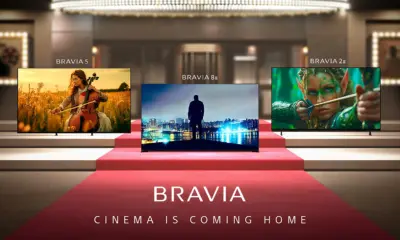

TCL expects H1 2025 net profit to surge over 80% YoY, driven by strong display gains

TCL is riding high on the back of a booming display business. The company announced on Friday that it expects to post operating revenue between 82.6 billion and 90.6 billion yuan (approximately $11.5 billion to $12.6 billion) for the first half of 2025, a modest 3% to 13% increase from last year. But the real story lies in its bottom line: net profit attributable to shareholders is expected to hit 1.8 to 2 billion yuan (about $250 million to $279 million), reflecting a massive year-on-year jump of 81% to 101%.

Strip away the one-time gains, and the core story only gets stronger. Excluding non-recurring items, TCL still expects profits between 1.5 and 1.65 billion yuan (around $209 million to $230 million), up a staggering 168% to 195%. The surge is largely driven by a standout performance in its semiconductor display unit, which reported net profits of over 4.6 billion yuan (roughly $640 million), an increase of more than 70% compared to the same period last year.

This isn’t just a fluke windfall. TCL has been quietly recalibrating its business over the past few years, shifting resources and focus toward higher-margin technologies, particularly in the panel manufacturing space. Its recent move to acquire a 21.5311% equity stake in Shenzhen China Star Optoelectronics Technology Co., Ltd. isn’t just a financial maneuver. It is a strategic consolidation play that tightens TCL’s grip on the core technologies underpinning modern displays, from high-end TVs to next-generation automotive screens.

But not everything in the TCL empire is glowing.

TCL Zhonghuan, the group’s solar energy and PV materials arm, posted a gloomy forecast of its own. The company expects a net loss of 4 to 4.5 billion yuan (roughly $557 million to $627 million) in H1 2025, deepening from a 3.064 billion yuan (about $427 million) loss in the same period last year. The problems, it seems, are macro. Global photovoltaic installations did remain resilient in the first half of the year, with a sharp, short-lived demand spike in China’s distributed solar market during early 2025.

But by May, the music started to slow. Demand softened, inventories ballooned, and prices plummeted. Supply demand mismatches across the entire value chain pushed Zhonghuan into a corner, with falling product prices and inventory write-downs dragging margins underwater.

Still, TCL’s overall H1 narrative reads like a company doubling down on its strengths while weathering turbulence in longer term bets like solar. If anything, the latest results underline a sharper strategic divide within TCL. Display tech is delivering the goods now, while renewables may take longer to shine.

News

TCL Launches CrystalClip Open-Ear Earbuds with Swarovski Special Edition

TCL has announced the CrystalClip, a new pair of open-ear, clip-on earbuds designed for comfort and functionality. The earbuds feature a lightweight, titanium-reinforced design that ensures durability while providing a secure and pressure-free fit. TCL is targeting users who need all-day comfort and situational awareness during activities like commuting, exercising, or traveling.

TCL CrystalClip Specifications

The CrystalClip uses 10.8mm dual-magnetic dynamic drivers to deliver clear, balanced sound. It supports 3D Spatial Audio and Bass Boost, which can be customized using the TCL HOME app. TCL has also included dual-mic ENC (Environmental Noise Cancellation) to ensure high-quality voice calls, even in busy surroundings.

TCL has equipped the earbuds with several smart features. Users can activate voice assistants like Siri or Google Assistant through customizable touch gestures. The earbuds also support real-time translation, enabling users to listen to translated audio while traveling or attending international events. They allow seamless switching between two devices and use Google Fast Pair 3.1 for quick connections with compatible Android devices.

The earbuds provide up to 8 hours of playback on a single charge and extend to 36 hours with the charging case. A 15-minute charge adds 3 hours of listening time. TCL has also ensured the earbuds are IPX4-rated for sweat and splash resistance, making them suitable for workouts and outdoor use.

TCL has released a special Swarovski edition of the CrystalClip. This version features a detachable crystal accessory shaped like a rose. Users can attach the accessory to the earbuds or use it as a decorative piece on bags, hats, or clothing.

Pricing and Availability

The standard CrystalClip earbuds will launch in February 2026 for €79. The Swarovski edition will retail for €149 and will be available starting in Q2 2026. Both versions will be released in Asia-Pacific, Europe, and North America.

In related news, TCL overtook Samsung in global TV shipments during December 2025.

News

TCL overtakes Samsung in global TV shipments for December 2025

TCL has officially dethroned Samsung as the top global TV shipper for December 2025, according to Counterpoint Research’s latest data. This marks a major milestone for the Chinese electronics giant, whose shipments surged 10% year-over-year (YoY) last month, giving it a commanding 16% market share. Meanwhile, Samsung, the perennial leader, slipped to second place with a 13% share, despite an 8% YoY increase in shipments.

So, what’s behind TCL’s meteoric rise? Aggressive pricing strategies and a robust lineup of mid-range and high-end TVs, including the well-received QM8K and QM9K series, played a key role. The company also launched the budget-friendly T7 series, which was heavily discounted during the holiday season. Combined with strong performance in Asia-Pacific, China, and the Middle East, TCL’s late-year surge was enough to outpace Samsung, at least for December.

However, Samsung still holds the crown for Q4 2025 overall, shipping 2% more TVs than TCL during the period. While North and South America provided growth opportunities for Samsung, declines in Western Europe and the Middle East hurt its performance. On the flip side, Hisense, which took third place in December, saw its shipments plummet 23% YoY, highlighting significant struggles in China’s shrinking TV market.

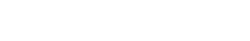

Looking ahead, TCL’s ambitions could spell bigger trouble for Samsung. The company’s upcoming partnership with Sony’s BRAVIA brand, set to finalize in March 2026, positions TCL to make a serious play in the premium TV market, a territory that Samsung has historically dominated with its high-end OLED and 8K offerings. If TCL can successfully leverage Sony’s reputation in this space, the dynamic of the global TV market could shift dramatically.

For now, TCL’s December triumph might be temporary, but its growth trajectory is impossible to ignore. With a mix of strategic pricing, regional demand timing, and potential premium market expansion, Samsung’s top spot may no longer be as secure as it once was.

News

TCL Shocks Market by Taking Over Sony Bravia TVs

Sony Corporation has announced that it will spin off its home entertainment division and form a new joint venture with TCL Electronics. The partnership gives TCL a 51 percent majority stake, while Sony retains 49 percent. The new company will take control of global operations for Sony’s television and home audio business.

The companies confirmed the agreement through a signed memorandum of understanding. They plan to finalize binding terms by the end of March 2026. The joint venture is expected to begin operations in April 2027, subject to regulatory approvals.

The new entity will handle the entire value chain, including product development, manufacturing, sales, and customer service. Products from the venture will continue to use the Sony and Bravia brand names.

Sony will contribute its picture processing technology, audio expertise, and brand value. TCL will provide its display manufacturing capabilities, global supply chain, and cost-efficient operations. TCL’s recent growth in display technology and global market share positions it to take advantage of Sony’s premium image and distribution network.

Sony CEO Kimio Maki said the partnership aims to create new customer value through combined expertise. TCL Chairperson Du Juan said the deal will allow TCL to scale further into high-end markets and optimize its operations.

Sony has been gradually moving away from consumer hardware in favor of content businesses like anime, film, music, and gaming. The company previously exited the PC and tablet markets and stopped producing Blu-ray players.

This move ends Sony’s independent control of its TV business, which began in the 1960s. The joint venture gives TCL an opportunity to strengthen its position in premium global markets while maintaining the Bravia brand’s legacy. Sony will retain visibility in the home entertainment segment without managing day-to-day hardware operations.

In related news, TCL has introduced the 5G Mobile WiFi P50 and the WiFi Router BE36 at CES 2026, while also unveiling the world’s first HDR10 AR glasses, the RayNeo Air 4 Pro.

(Source)