News

TCL Rules China’s TV Market as MOKA Leaves Rivals in the Dust

In China’s fiercely competitive television market, TCL has once again proven it’s not just playing to win, it’s playing to control the game. According to new data from research firm RUNTO Technology, TCL-branded TVs shipped over 600,000 units in May, making it the No.1 TV brand in the country for the month. But the real story lies behind the scenes. TCL’s secret weapon isn’t just its sleek Mini LED panels or aggressive pricing; it’s MOKA, its little-known but massively powerful in-house manufacturing arm.

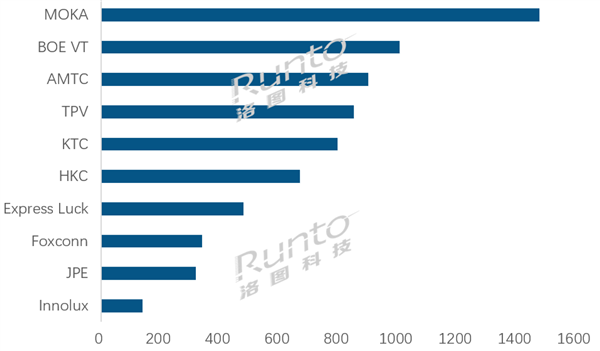

MOKA, formally known as Moka Technology, shipped nearly 1.5 million units in May alone, marking its best month in 2025 so far. That’s not just a flex, it’s a full-on chokehold on the OEM segment. The firm now leads the professional TV OEM sector with a staggering 50% margin over its closest rival. Year-on-year, MOKA grew 7%, while monthly growth hit 13.5%. For context, that kind of momentum in hardware logistics, especially in a market flooded with volatility, isn’t just impressive, it’s strategic domination.

Trailing behind is BOE VT, the OEM arm of panel powerhouse BOE, which made a noticeable climb to second place with over 1 million units shipped. The company jumped four spots from the previous month, an encouraging sign that it’s gaining traction. But despite this growth spurt, BOE VT still lags far behind MOKA’s crushing lead.

Shenzhen MTC, known in the market as AMTC, remained steady in third place with roughly 900,000 units. TPV, which builds TVs for Philips and AOC, came in fourth at 850,000 units. These brands are holding their ground, but it’s increasingly clear they’re running in a race that TCL has already started lapping them in.

Konka-backed KTC and display manufacturer HKC placed fifth and sixth, with 800,000 and 670,000 units respectively. These numbers suggest solid consistency, but again, they pale next to MOKA’s towering presence.

On the lower end of the list, traditional heavyweights like Foxconn and Innolux are slipping. Foxconn managed just 340,000 units, while Innolux barely registered at 140,000. Both saw significant declines compared to last year, signaling that legacy power is no longer enough to keep pace in China’s hyperactive TV space.

The real takeaway here? TCL isn’t just a TV brand anymore; it’s an ecosystem. And with MOKA’s muscle behind it, TCL is reshaping the rules of the OEM game, all while keeping its rivals looking over their shoulders.

(Via)

News

TCL Shocks Market by Taking Over Sony Bravia TVs

Sony Corporation has announced that it will spin off its home entertainment division and form a new joint venture with TCL Electronics. The partnership gives TCL a 51 percent majority stake, while Sony retains 49 percent. The new company will take control of global operations for Sony’s television and home audio business.

The companies confirmed the agreement through a signed memorandum of understanding. They plan to finalize binding terms by the end of March 2026. The joint venture is expected to begin operations in April 2027, subject to regulatory approvals.

The new entity will handle the entire value chain, including product development, manufacturing, sales, and customer service. Products from the venture will continue to use the Sony and Bravia brand names.

Sony will contribute its picture processing technology, audio expertise, and brand value. TCL will provide its display manufacturing capabilities, global supply chain, and cost-efficient operations. TCL’s recent growth in display technology and global market share positions it to take advantage of Sony’s premium image and distribution network.

Sony CEO Kimio Maki said the partnership aims to create new customer value through combined expertise. TCL Chairperson Du Juan said the deal will allow TCL to scale further into high-end markets and optimize its operations.

Sony has been gradually moving away from consumer hardware in favor of content businesses like anime, film, music, and gaming. The company previously exited the PC and tablet markets and stopped producing Blu-ray players.

This move ends Sony’s independent control of its TV business, which began in the 1960s. The joint venture gives TCL an opportunity to strengthen its position in premium global markets while maintaining the Bravia brand’s legacy. Sony will retain visibility in the home entertainment segment without managing day-to-day hardware operations.

In related news, TCL has introduced the 5G Mobile WiFi P50 and the WiFi Router BE36 at CES 2026, while also unveiling the world’s first HDR10 AR glasses, the RayNeo Air 4 Pro.

(Source)

News

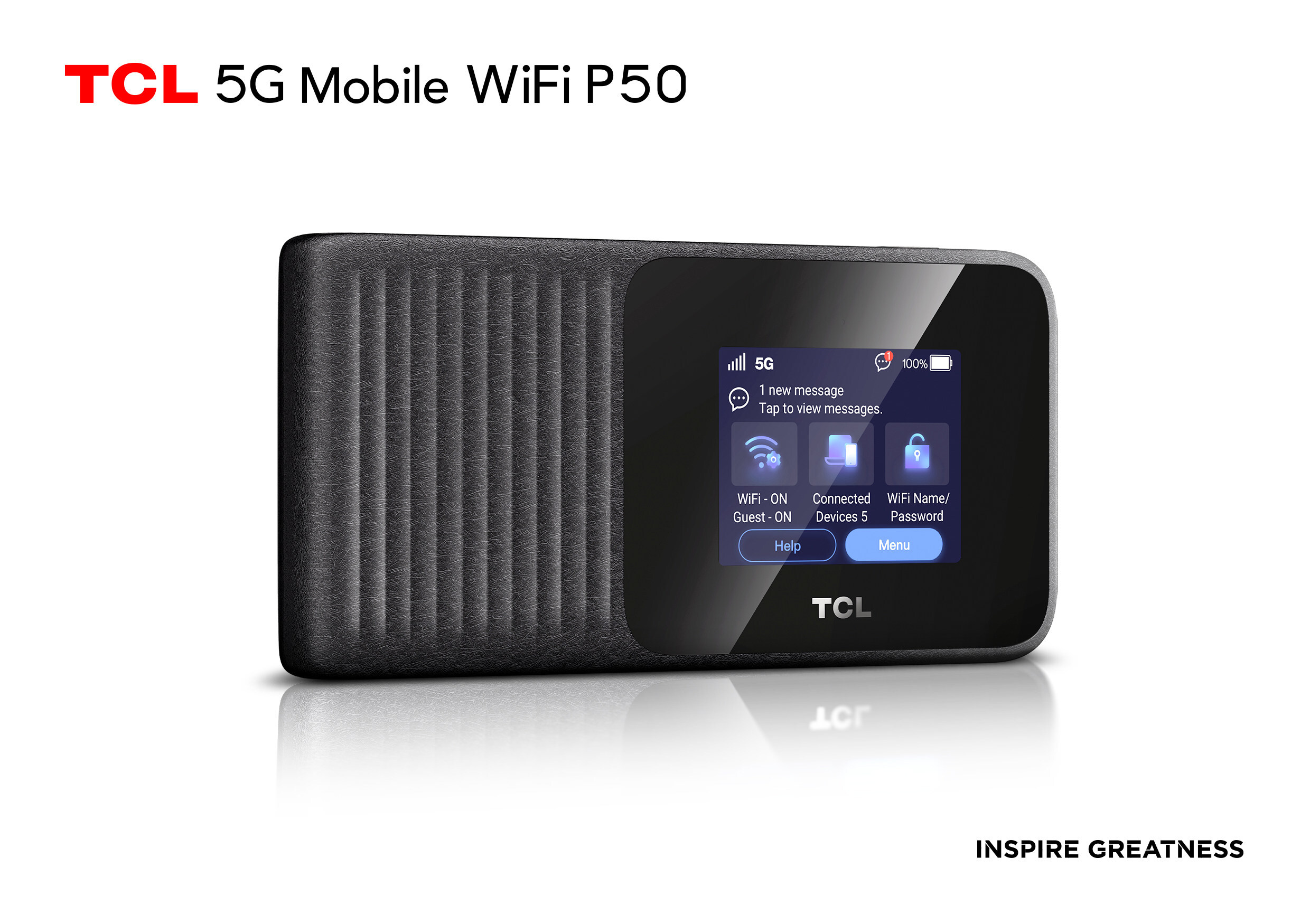

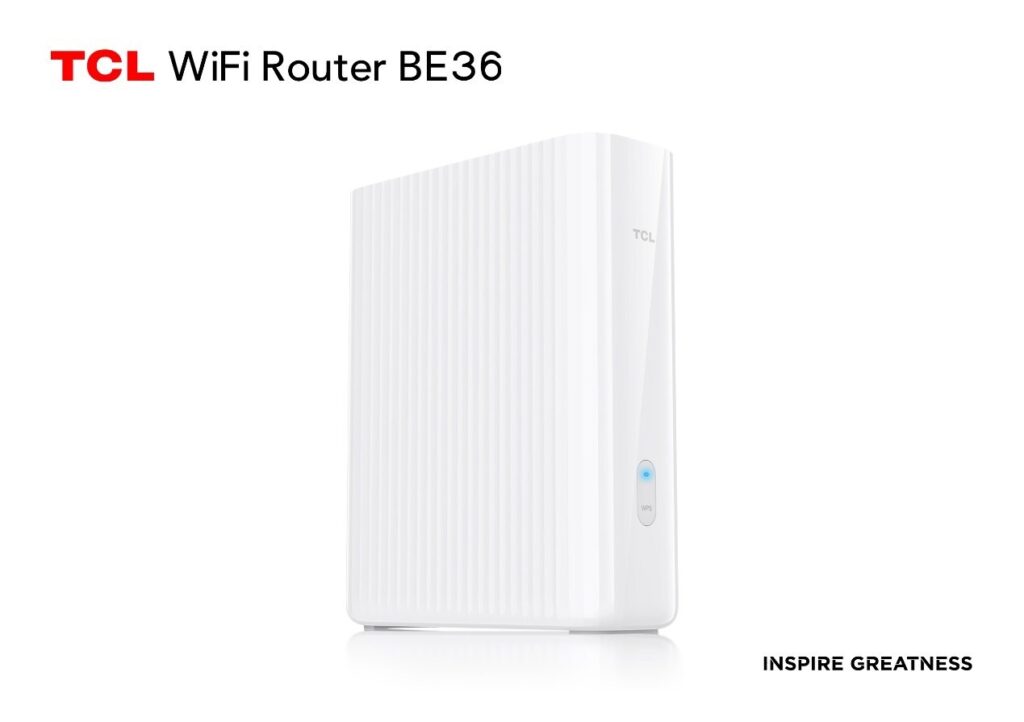

TCL Launches 5G Mobile WiFi P50 and WiFi Router BE36 at CES 2026

TCL is done waiting for the future of connectivity; it just launched it. At CES 2026, the company unveiled the 5G Mobile WiFi P50 and WiFi Router BE36, two devices designed to cover the entire spectrum of modern connectivity needs, from your backyard to your basement office.

The TCL 5G Mobile WiFi P50 is more than a pocketable hotspot. It’s the first 5G mmWave mobile router that also supports both fast charging and wireless charging. It packs a 5000mAh battery for up to 12 hours of portable use, doubles as a power bank, and features a 2.4-inch touchscreen for live network stats. On the connectivity side, it delivers up to 3.97Gbps via full-spectrum 5G (mmWave + Sub-6), and tri-band Wi-Fi 7 speeds topping 5.8Gbps for up to 64 devices. There’s even a Gigabit Ethernet port for times when wireless just won’t cut it.

While the P50 is built for mobility, the TCL WiFi Router BE36 is focused on home performance. It offers 3.6Gbps Wi-Fi 7 across dual bands, supports up to 512 device connections, and leverages 3T3R (2ss) antenna tech to boost range. It’s EasyMesh R6 compatible too, meaning you can deploy multiple units to blanket large homes in a seamless, zero dead-zone network.

Security hasn’t been left behind either. The BE36 includes firewall-level protection with malware filters, brute-force attack detection, and smart-home security baked in. There’s even a built-in VPN suite and a dedicated gaming acceleration mode. Rounding it off is a 2.5GE port for serious wired performance.

In related news, TCL also unveiled the RayNeo Air 4 Pro, billed as the world’s first HDR10-enabled AR glasses, alongside the NxtPaper 70 Pro tablet with a dedicated eye-care display and stylus support at CES 2026.

News

TCL Unveils World’s First HDR10 AR Glasses: RayNeo Air 4 Pro at CES 2026

TCL’s RayNeo has introduced the RayNeo Air 4 Pro AR glasses at CES 2026. The device is the world’s first AR glasses to support HDR10, aiming to deliver a cinema-like viewing experience in a lightweight wearable form.

RayNeo originally launched the Air 4 Pro in China last year. The company is now taking the product global, positioning it as a new category of “head-mounted TV.” The glasses feature a 201-inch virtual display at a 6-meter distance and weigh just 76 grams. They connect to USB-C display output devices, including smartphones, tablets, laptops, and gaming consoles such as the Nintendo Switch 2.

The Air 4 Pro is powered by the custom Vision 4000 chip. The processor enables real-time video enhancements, including upscaling SDR content to HDR and converting 2D video into 3D. The glasses support HDR10 for richer contrast and more vibrant color reproduction.

For audio, RayNeo collaborated with Bang & Olufsen to design a four-speaker system. The glasses use directional sound tubes to provide immersive audio while minimizing sound leakage. The sound system has been fine-tuned by B&O’s audio engineering team.

The design focuses on comfort and portability. Adjustable nose pads and a balanced frame allow for extended use. The lightweight build makes it suitable for travel and on-the-go entertainment.

RayNeo plans to launch the Air 4 Pro globally on January 25 for $299. The price undercuts many other AR glasses in the market, making it one of the most affordable options in its class.

If you are planning to buy an AR headset right now, the Air 3s Pro is also worth considering, as it is currently on sale for $249.